Gold is not just a metal in India. It is an emotion, a safety net, and for many families, a form of long-term savings. From weddings to festivals, from small investors to big traders, everyone keeps an eye on the gold rate in India. But one common question remains: why does the gold price change every day, and how should you decide when to buy or sell?

This article breaks it down in a simple, practical way so you actually understand what is happening and how it affects your money.

Today’s Gold Rate in India: What You Should Know

Gold prices in India are usually quoted for 24K, 22K, and 18K gold.

- 24K gold is the purest form and mostly used for investment

- 22K gold is commonly used for jewellery

- 18K gold is used for designer and lightweight jewellery

The gold rate changes daily and sometimes even multiple times a day. This happens because Indian gold prices are linked to global markets and currency movement.

Why Gold Rate in India Keeps Changing

Many people think gold prices go up or down randomly. That is not true. There are clear reasons behind every move.

Global Gold Price Impact

Gold is traded internationally in US dollars. When global gold prices rise, Indian prices usually rise too. If global prices fall, India also sees a drop.

Any global tension, war news, financial crisis, or fear of recession pushes people towards gold, increasing its price.

Dollar vs Rupee Value

Gold is imported into India, and payment happens in dollars.

- If the Indian rupee weakens, gold becomes more expensive

- If the rupee strengthens, gold becomes cheaper

Even if global gold prices stay stable, a falling rupee can push gold rates higher in India.

Inflation and Interest Rates

Gold is seen as protection against inflation. When inflation rises and bank interest rates are low, people prefer gold over savings accounts or fixed deposits.

This increased demand pushes the gold rate up.

Festival and Wedding Demand

In India, gold demand increases sharply during festivals like Diwali, Dhanteras, Akshaya Tritiya, and wedding seasons.

Higher demand during these periods often leads to higher prices.

Government Taxes and Import Duty

Gold prices in India include:

- Import duty

- GST

- Local jeweller charges

Any change in government policy directly affects the final gold rate you pay.

Gold Rate in India: City-Wise Difference

Gold prices are almost similar across cities, but small differences exist due to local taxes, transportation costs, and jeweller margins.

Major cities where people track gold rates closely include:

- Delhi

- Mumbai

- Chennai

- Kolkata

- Bengaluru

- Hyderabad

Before buying, always compare local jeweller rates with the official daily rate.

Is This the Right Time to Buy Gold?

This is the most searched question related to gold.

The honest answer is: it depends on your purpose.

For Jewellery Buyers

If you are buying gold for a wedding or personal use, timing matters less. Focus more on:

- Purity

- Making charges

- Hallmark certification

A small price difference will not matter much in the long run.

For Investors

If your goal is investment, then:

- Avoid buying during sudden price spikes

- Consider buying in small amounts over time

- Look at long-term trends, not daily movement

Gold works best as a long-term hedge, not a short-term trading tool.

Sony Electric Cycle Launched-Offers 150km Range, Top Features, and EMI of Just ₹899

Physical Gold vs Digital Gold vs Gold ETF

Today, gold is not limited to jewellery or coins.

Physical Gold

Pros:

- Tangible asset

- Emotional value

Cons:

- Storage risk

- Making charges

- Lower resale value

Digital Gold

Pros:

- Easy to buy and sell

- No storage issue

- Can start with small amounts

Cons:

- Platform dependency

Gold ETF and Sovereign Gold Bonds

Pros:

- Safe

- No making charges

- Better returns in some cases

Cons:

- Market-linked

- Not physical possession

Choose based on your comfort and financial goals.

Gold Rate Trend in India: Long-Term View

If you look at history, gold has rewarded patient investors. Despite short-term ups and downs, gold prices in India have increased steadily over the years. People who bought gold during uncertain times usually benefited in the long run. This is why gold remains one of the most trusted assets in Indian households.

Common Mistakes People Make While Buying Gold

Avoid these common errors:

- Buying without checking hallmark

- Ignoring making charges

- Panic buying during sudden price jumps

- Not comparing rates from multiple jewellers

A little awareness can save you a lot of money.

Final Thoughts: Gold Rate in India and Smart Decisions

The gold rate in India is influenced by global markets, currency movement, inflation, demand, and government policies. Prices will keep moving. That is normal. Instead of trying to predict daily changes, focus on:

- Your goal

- Long-term value

- Buying from trusted sources

Gold is not about quick profit. It is about stability, trust, and security. If you understand how gold prices work, you can make better decisions and protect your hard-earned money.

| Join Our Group |

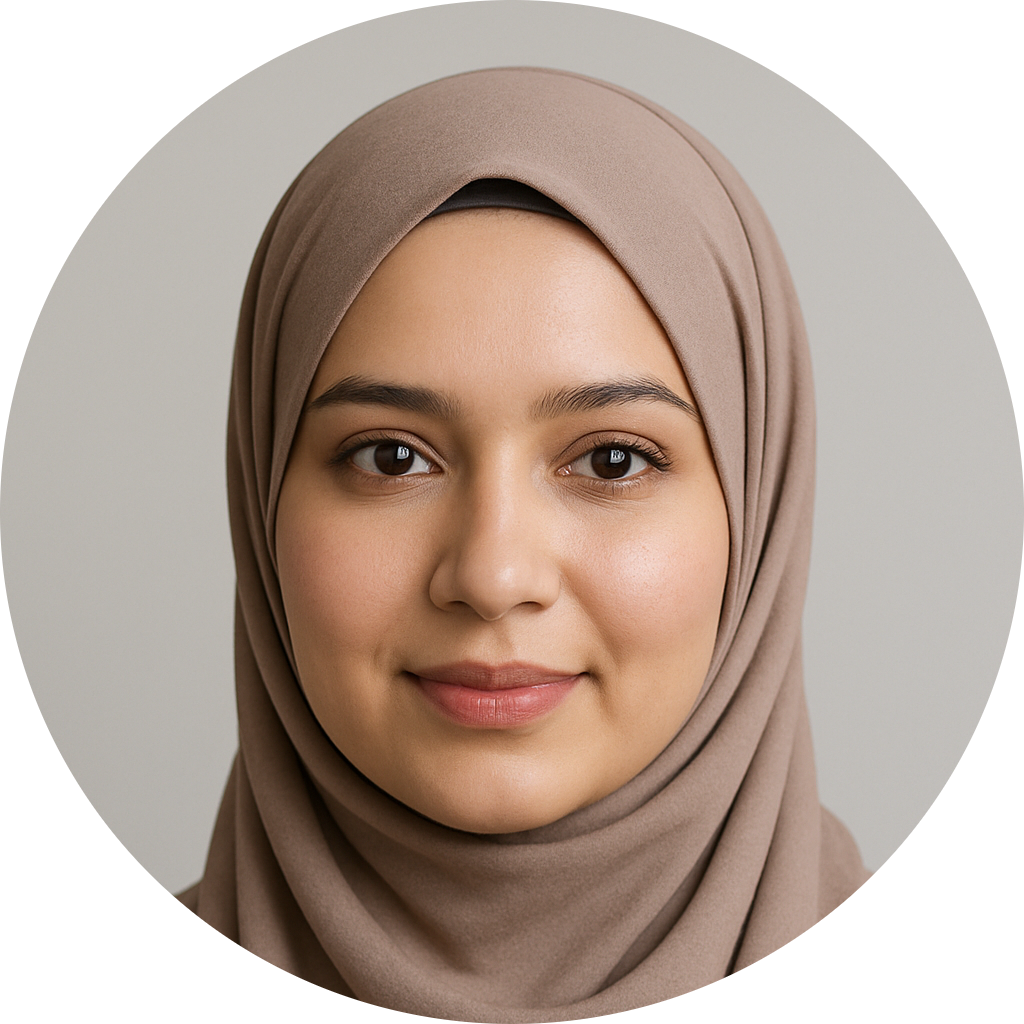

My name is Anaya Afrin, the founder of Seekho Smart. I built this platform to make knowledge simple, clear, and truly useful for students and readers everywhere. With over 6 years of blogging experience, I’ve learned how to turn complex topics into easy guides that inspire learning. Through my writing, I aim to share practical knowledge that not only informs but also empowers people to grow and achieve their goals.