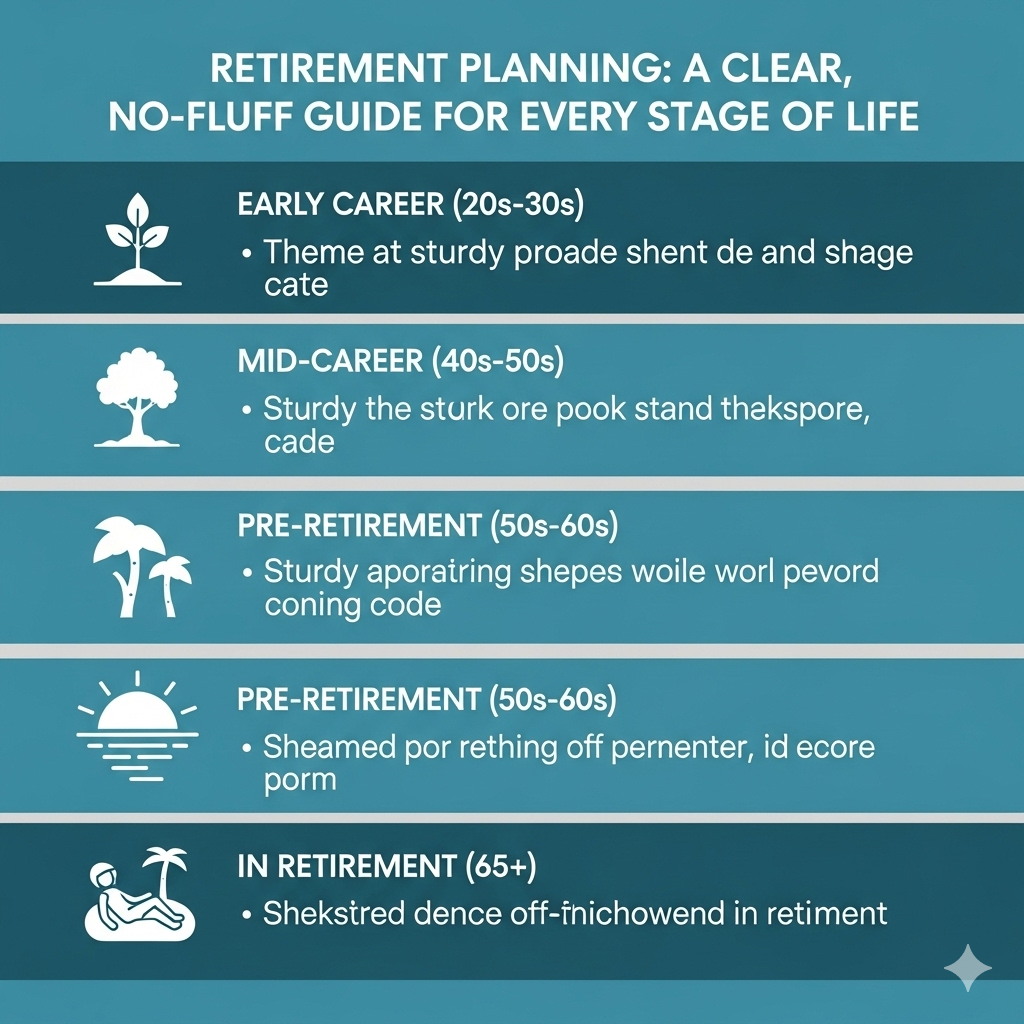

Why Retirement Planning Matters More Than Ever Today :- Retirement planning is not just about saving money it’s about creating a life where you can relax, enjoy your passions, and stay financially independent without worrying about running out of funds. The earlier you start, the easier the journey becomes. But even if you are late to the game, smart planning can still help you build security.

In this guide, we’ll break down retirement planning in a way that’s simple, practical, and human. You’ll learn how to calculate how much money you need, where to invest, how to avoid mistakes, and how to turn savings into reliable income. Think of this as your personal road map to a happy, worry-free retirement.

What Exactly Does Retirement Planning Mean in Real Life?

Retirement planning means preparing financially for the stage of life when you stop working full-time. Instead of depending on a pay check, you will depend on your savings and investments.

It’s about answering three big questions:

- How much will I need to live comfortably?

- How much do I need to save and invest?

- Where should I put my money so it grows safely over time?

Why You Should Start Retirement Planning Early Instead of Delaying It

- Many people postpone retirement planning, thinking they have plenty of time. The truth is, time is your biggest asset.

- Compounding effect: Money invested today has decades to grow, like a snowball rolling downhill.

- Less pressure later: The earlier you start, the less you need to save every month. If you delay, you’ll need to save two or three times more to catch up.

- So whether you are in your 20s or already in your 40s, the best time to start is now.

How Much Money Do You Really Need for Retirement?

- This is the most common question. The answer depends on your lifestyle, spending habits, and life expectancy.

- The 25x rule: A quick formula is to save at least 25 times your expected annual expenses. For example, if you want ₹10 lakh per year in retirement, aim for about ₹2.5 crore as a retirement fund.

- Consider inflation: Prices rise every year. What costs ₹1 lakh today may cost ₹3–4 lakh in 30 years. Always adjust your plan for inflation.

- Personal lifestyle: Do you plan to travel often? Or live a simple life at home? Your retirement fund must reflect your personal goals.

Step 1: Create a Clear Retirement Budget for Your Future

- To avoid guesswork, prepare a retirement budget now. Break it into three parts:

- Essential expenses – Rent, groceries, electricity, healthcare, transport.

- Lifestyle expenses – Vacations, hobbies, dining out, entertainment.

- One-time expenses – Buying a new car, house renovation, weddings, or big family functions.

- This budget gives you a clear target so you know how much you must save.

Step 2: Build a Strong Foundation with Four Types of Assets

- A good retirement portfolio should have a balance of different assets.

- Cash & emergency funds: Always keep 6–12 months of expenses in savings. This protects you during emergencies.

- Equities (stocks or mutual funds): These help your money grow faster and beat inflation.

- Debt instruments (bonds, fixed deposits, PPF): These provide safety and stability.

- Real assets (property or gold): Add extra diversification if it fits your budget.

Step 3: Choose the Right Retirement Accounts and Investment Tools

- Your country may offer special retirement accounts or pension plans. These accounts often give tax benefits too.

- Employer retirement plans or pensions: Always take full advantage of employer contributions if offered.

- Government-backed plans (like Provident Fund, NPS, Social Security): These provide guaranteed returns with low risk.

- Mutual funds and ETFs: Use them for long-term growth at low cost. Index funds are a great choice.

Step 4: Asset Allocation That Matches Your Age and Risk Level

- The mix of equity, debt, and cash changes as you grow older.

- 20s and 30s: High equity allocation (70–80%) because you have time to recover from market falls.

- 40s: Balanced approach with 60% equity and 40% debt.

- 50s: Start shifting more into debt and stable assets.

- 60s: Focus more on safety, but keep some equity (30–40%) to beat inflation.

Step 5: Protect Your Retirement with the Right Insurance

- Insurance is like a shield that prevents unexpected events from destroying your retirement savings.

- Health insurance: Must-have to cover hospital and medical costs.

- Term life insurance: If your family depends on your income, protect them with life cover.

- Critical illness or disability insurance: Extra protection in case of sudden health issues.

Step 6: Understand Taxes So You Keep More of Your Money

- Taxes reduce your returns if you don’t plan wisely.

- Use tax-saving retirement accounts whenever possible.

- Mix tax-deferred and tax-free options so you can control how much tax you pay later.

- In retirement, withdraw money in a tax-efficient way to stretch your savings further.

Step 7: Automate Your Savings and Investments

- The best way to build wealth is to automate it.

- SIP (Systematic Investment Plan): Invest a fixed amount every month automatically.

- Auto-increase: Raise your monthly investment by 5–10% every year, especially when your salary increases.

- This way, you don’t rely on willpower and stay consistent.

Step 8: Know the Big Risks That Can Break Your Retirement

- Three major risks can harm your retirement:

- Market risk: If markets crash right after you retire, your savings may run out early.

- Longevity risk: Living longer than expected means you need more money.

- Inflation risk: Rising prices eat away at your fixed income.

- Managing these risks means keeping a balanced portfolio and not relying only on one source of income.

Step 9: How to Turn Savings Into Reliable Monthly Income

- Retirement is not just about saving. It’s also about spending wisely.

- Safe withdrawal rule (3–4%): Withdraw about 3–4% of your total savings each year. This helps your money last longer.

- Annuities and pensions: Guarantee a fixed income for life but offer less flexibility.

- Systematic Withdrawal Plans (SWP): A smart way to withdraw from mutual funds while keeping money invested.

Step 10: Don’t Ignore Estate Planning and Legal Preparation

- Retirement planning also includes what happens after you’re gone.

- Make a will: Clearly state who gets your assets.

- Name nominees and beneficiaries: Avoid family disputes.

- Power of attorney: Allow someone you trust to handle your finances if you can’t.

Step 11: Avoid These Common Retirement Planning Mistakes

- Spending more as income grows (lifestyle creep).

- Delaying investments waiting for the “right time.”

- Relying only on real estate or fixed deposits.

- Ignoring inflation in calculations.

- Not reviewing and rebalancing investments regularly.

Step 12: Create a Simple One-Year Action Plan to Kickstart Retirement Planning

- Here’s a 12-month roadmap:

- Month 1–2: List your retirement goals and estimate monthly expenses.

- Month 3–4: Get insurance (health + life).

- Month 5–6: Start SIPs in equity and debt funds.

- Month 7–8: Build your emergency fund.

- Month 9–10: Prepare your will and assign nominees.

- Month 11–12: Review progress, rebalance portfolio, and increase savings.

Conclusion: Retirement Planning Is About Freedom, Not Just Money

Retirement planning is really about giving yourself freedom. Freedom from worrying about bills, freedom to travel, freedom to spend time with loved ones, and freedom to live life on your terms. The key is to start early, invest wisely, and review your plan regularly. Even if you start late, smart steps can still secure your future.

Remember, your money should work for you, not the other way around.

FAQs

- How much should I save for retirement each month?

Try to save at least 20% of your income. If that’s hard, start with 10% and increase over time. - What is the safest investment for retirement?

A mix of equity mutual funds, bonds, and government-backed plans is safer than relying on a single investment. - Should I invest in gold for retirement?

Gold can be part of your portfolio, but not more than 10%. It’s better for diversification, not income. - Can I retire early if I save aggressively?

Yes, early retirement is possible if you save a higher percentage (30–50%) of your income and invest it smartly. - How often should I check my retirement plan?

Review once or twice a year. Adjust if your income, expenses, or goals change.

Also Read :- Yamaha Electric Cycle 2025 Launched with Stylish Design & 250 KM Range at ₹4,499

Join Our Group

My name is Anaya Afrin, the founder of Seekho Smart. I built this platform to make knowledge simple, clear, and truly useful for students and readers everywhere. With over 6 years of blogging experience, I’ve learned how to turn complex topics into easy guides that inspire learning. Through my writing, I aim to share practical knowledge that not only informs but also empowers people to grow and achieve their goals.